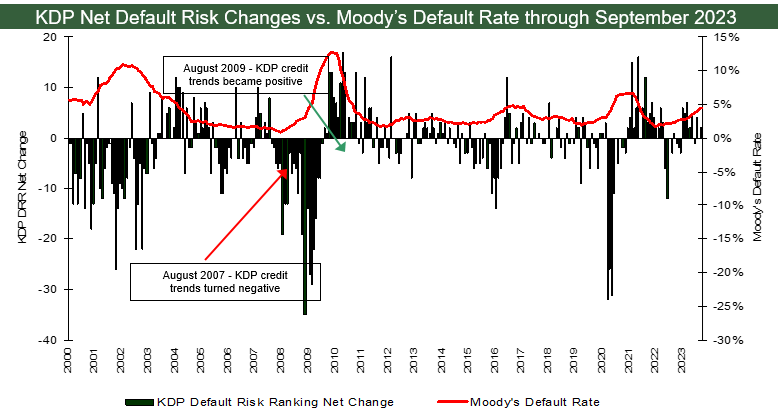

The cornerstone of our investment process is our proprietary research and Default Risk Ranking (DRR). We actively follow over 250 companies and provide multiple daily pricing updates on more than 600 securities. Analysts prepare initial write-ups, quarterly earnings comments and as-needed updates for all companies followed including a detailed company analysis, fully integrated financial model with 3 year forward projections, DRR and investment recommendation. Our unique forward-looking DRRs assess a company's probability of default over 2 and 5-year time horizons and are critical to our investment selection and portfolio construction process.